Flood Insurance Rate Maps (FIRMs) are a good place to start when identifying your hazards, but have many limitations.

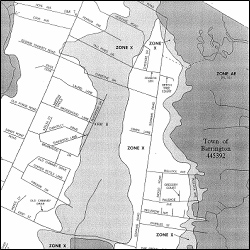

As a part of the National Flood Insurance Program (NFIP), the Federal Emergency Management Agency (FEMA) periodically conducts Flood Insurance Studies (FISs) and uses the results of these studies to produce FIS reports and Flood Insurance Rate Maps (FIRMs). FIRMs show the estimated extent of flooding during a hypothetical “100-year storm” (also called a 1% storm)—a storm that has an estimated 1% chance of being equaled or exceeded during any given year. (Note: A 100-year storm can occur more than once a century.)

First things first: how do you get your flood maps? Your community should have paper copies, but if you’d like them online, head to this page on FEMA’s Map Service Center’s website where you’ll be able to get a FIRM in one of several ways. Alternatively, you can use Google Earth to view your community’s FIRMs.

Once you’ve gotten your FIRMs, now you need to correctly interpret them. This can be complicated. Following are some resources to help.

- The FEMA introductory fact sheet, Using a Flood Insurance Rate Map (FIRM).

- An animated FEMA tutorial on FIRMs.

- The FEMA Map Services Center, which maintains copies of all FIRMs and FIS reports.

- FEMA’s FIRMette tutorial, which provides instructions for determining the flood designation for an individual parcel by creating a “FIRMette” (a section of a FIRM for a specific address or location).

- The National Flood Insurance Program website, which has information on FISs, FIRMs, and other floodplain management issues. Check out the Frequently Asked Question section for starters.

- FEMA also offers an “ask the experts” service: email your question to asktheexpert@riskmapcds.com. They claim most inquiries are answered within 5 business days.

- The Massachusetts Office of Coastal Zone Management’s article, The Art and Science of Identifying Flood Zones has useful general information on reading FIRMs.

- If you still can’t find your answer, contact Rich Zingarelli, Massachusetts NFIP Coordinator, at Richard.Zingarelli@state.ma.us or (617) 626-1406.

Also see: understanding the limitations of FIRMs and FIS reports.

* Your community needs only 500 points to qualify for reduced flood insurance premiums through the Community Rating System (CRS). For more information (including how to apply for the CRS program), see our Community Rating System (CRS) primer.

* Your community needs only 500 points to qualify for reduced flood insurance premiums through the Community Rating System (CRS). For more information (including how to apply for the CRS program), see our Community Rating System (CRS) primer.

Notes from the folks at CRS:

“Communities providing inquirers with information from the local government’s Flood Insurance Rate Map and Flood Insurance Study may receive credit under Activity 320. To receive this credit the community must tell inquirers if the property is in the SFHA, the COBRA System, or a coastal A Zone or erosion zone if they have been mapped. The community must also advise inquirers about the mandatory flood insurance purchase requirement, and publicize this service annually.”